As the global center of economic activity gradually shifts from the Atlantic to the Pacific, a discussion about Europe’s connectivity to the world is long overdue. Historically, it was Europe that discovered the world, from Marco Polo to the Portuguese Caravellas. We are now faced with our own discovery and we can react with fear or clear rules and openness. A multipolar world is a bit like rain: sometimes revitalizing, sometimes volatile, but absolutely unavoidable. Europe can no longer “coordinate,” there needs to be a deeper discussion about vision and direction. Markets force this discussion upon us, not least the so-called new “Silk Road,” the connectivity project promising to reframe the conversation on Europe’s economic agency in the 21st century. We should embrace this discussion with gusto.

At the moment BRI is going on in Europe without Europe. The lack of a European Framework prevent from consolidating a long term vision of a comprehensive strategic partnership, threaten the credibility of Europe as equal partner of China, undermine the effectiveness of the China-Europe joint efforts to address the global challenges and commitments in the framework of multilateral agreements (global sustainable development and Agenda 2030, climate change, energy security, fight against poverty).

Without a strong European framework the cooperation with China will bring less and less benefits to the Member States who seek to deal individually with the Asian giant. Risking turning Europe into the playground of competition between the two superpowers.

Europe wakes up to Chinese presence

In November 2010 the British prime minister David Cameron arrived in Beijing for a visit heralded by the conservative press as “the biggest trade mission in 200 years.” Taking a step further, in March 2015 the White House issued a pointed statement expressing its disappointment in the decision of the UK to sign onto the Asian Infrastructure Investment Bank (AIIB), created to fund infrastructure projects thereby facilitating the Chinese global connectivity vision known as the “One Belt, One Road” BRI initiative. And months before the referendum on EU membership, in March 2016, London emerged as the single biggest clearing center for renminbi transactions outside China. While China invests in nuclear infrastructure in cooperation with a French state-owned company. In sum, Italy is hardly the first G7 economy to aspire to a special relationship with China.

Fast forward four years, a Memorandum of Understanding (MoU) was signed between Italy and China on March 23, admonished as the first bilateral agreement of its kind that Beijing signs with a G7 economy. This catchphrase captured imagination whilst putting the Italian government on the spot. There is little economic substance in the claim. Germany’s relationship with China is by far the most special in Europe, as it is the only country in the world with a trade surplus vis-à-vis China and a turnover of €180bn, followed by the UK (€80bn), France (€55bn) and only then Italy (€40bn). Even institutionally, Italy was hardly a trailblazer. Croatia, the Czech Republic, Hungary, Greece, Malta, Poland and Portugal have signed similar bilateral agreements.

Fast forward four years, a Memorandum of Understanding (MoU) was signed between Italy and China on March 23, admonished as the first bilateral agreement of its kind that Beijing signs with a G7 economy

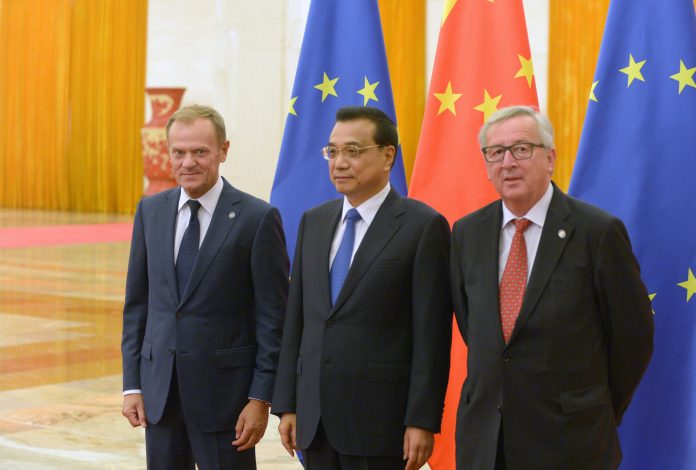

But something was different in the way Euro-Atlantic partners perceived the event. Days before the signature of the Italian-Chinese MoU, a report sponsored by the European Commission President Jean-Claude Juncker and the EU’s Foreign Policy chief, Federica Mogherini, labelled China an “an economic competitor and systemic rival” and called for EU-wide regulatory oversight mechanism. Rome was warned to be cautious. A week earlier, the White House called the BRI initiative a “made by China, for China” project and expressed the view that the deal would not have “sustained economic benefits” for the Italian people. Suddenly, the relatively standard aspiration of yet another “special relationship” with China was portrayed as the short-sighted pursuit of unilateral objectives.

The context in which this visit took place was maybe underestimated. The issue at hand was less whether the MoU was a mistake and more about the absence of comprehensive EU framework of dealing with China.

The European Commission had just blocked the Alstom-Siemens merger, underpinned by the logic of a European champion. Washington is piling up pressure on Europe, where Huawei plays a pivotal role in the development of 5G infrastructure in the UK, Germany, Poland, and elsewhere. And Germany introduced a law limiting takeovers of strategic technology sectors. In sum, there is heightened and perhaps justifiable caution over China’s ambition to lead in key manufacturing and technology sectors. But this fear has little if anything to do with Italian policy. The main fear was that Rome could have made irreversible choices, carving its own direction before Europe even had the chance to formulate a coherent China strategy.

In Europe, Without Europe

The real problem is that China has invested in Europe through EU member states, while Brussels has been reluctant to demand a common framing of Sino-European relations. To put things in perspective, 20 EU member states – and four G7 member states – have joined the AIIB, becoming stakeholders in the BRI. Thirteen EU member states have signed MoUs with China, while the 16 plus 1 initiative cuts across the EU and the Western Balkans and is about to engage Greece. From the Port of Piraeus to the Duisburg Terminal in Germany, member states aim to establish linkage with the emerging Pacific economy. The Chinese investment in the ports of Trieste and Genova reflect a long period of reflection and engagement. One should recall the participation of former premier Paolo Gentiloni at the 2017 Belt and Road Initiative Forum, signaling the intention to link Italy to the 21st Century Maritime Silk Road.

The real problem is that China has invested in Europe through EU member states, while Brussels has been reluctant to demand a common framing of Sino-European relations

In sum, the 2015 China-EU connectivity platform has largely been a member state affair. For over a decade, there have been as many “special relationship” narratives in Europe as there are member states, all of whom are of whom make sense from a Chinese perspective, but which from a European perspective are strategically incoherent. That incoherence is not the result of Chinese cunning but the cumulative result of Europe failing to act as a unitary actor. It was not before the autumn of 2018 that the EU did put forward an Asia Connectivity Strategy (ACS), addressing transport, energy and digital networks. At the moment, this is more of a vision than a plan, complete with financial instruments.

“Who do I call if I want to speak to Europe?” Henry Kissinger allegedly said. Authentic or not, the quote expresses something real: the centrifugal power of the American power in Europe, which forges singular purpose, often in view of a common threat. This diplomatic culture will no longer suffice because Europe faces strategic dilemmas that do not simply require mobilization but actually a vision.

The introduction of US tariffs on European steel and aluminum and the threat of secondary sanctions on European companies operating in Iran brings to the fore the possibility of a cleavage between Euro-Atlantic interests. Likewise, Germany has been vocal about the desire to veto takeovers that would result in strategic technology transfer, as in the case of Kuka (2016), whilst defending its prerogative to work with Chinese firms in developing 5G infrastructure. In sum, Europe is coming to terms with the lack of a strategic narrative but that does not mean that China has a “master plan” for domination. China merely snaps up opportunities: for instance, strategic assets in Greece and Portugal were bought at the height of the sovereign debt crisis, when European investors would not touch them, largely because Beijing believed that the European project would bounce back more than Brussels.

Where do we go now

Undoubtedly, China does have the ambition of leadership in key industrial sectors, but at this stage Beijing is willing to discuss intellectual property. For China, Europe is a scouting ground not only for technology but also for policies. Since the 1990s, Italy-China bilateral cooperation extends from University Research Centers to joint industrial projects. Among the programs, I want to remember the Sino-Italian environmental cooperation, with more than 200 projects that have led the process of transforming the process of industrial management in China, because it is European regulation that drives the kind of innovation China needs.

Europe is coming to terms with the lack of a strategic narrative but that does not mean that China has a “master plan” for domination

Clearly, China has played a major role in European economic recovery. European industrial champions, such as Airbus, can thrive in a rules-based system. Less than week following the signature of the Italian MoU, President Emmanuel Macron and President Xi Jinping signed a deal to sell 300 Airbus planes to China Aviation Supplies Holding Company. Ultimately, the question is not whether you engage with the second biggest economy in the world but how. The case study points to the future, in which managed cooperation can lead to level-playing competition.

As regards to connectivity, the EU has the technology, capital, and infrastructure to become the second pillar and indeed a partner in the Europe-Africa-Asia flow, coauthoring terms of openness, interoperability, transparency, and sustainability based on high environmental and social standards. That is key to ensuring the relevance of European strategic objectives, such as the fast shift towards a carbon neutral and circular economy. As the Airbus case indicates, size matters and it is clear that to set rules at par, Europe must heed the concerns voiced by Bruno Le Maire and Peter Altmaier. European champions and integrated value chains are significant for the present and the future of the EU, as they hold in them the embryonic promise of a common European strategy.

Corrado Clini is former Minister of Environment of Italy, Senior advisor for GEIDCO (Global Energy Interconnection Development and Cooperation Organisation).

Euro-China relations expert Arvea Marieni has contributed to this article.